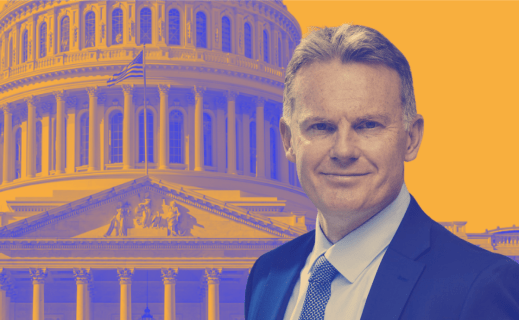

On the Hill Episode 21: Stan Middleman, Freedom Mortgage Founder and CEO

In this episode of "On the Hill," Tim Rood talks with Stan Middleman, Founder and CEO of Freedom Mortgage, the fifth largest U.S. lender in 2021, and the number one Federal Housing Administration and Veterans Administration (government-insured) lender. Middleman discusses his journey into the mortgage business during the sky-high interest rates in the 1980s.

"People in the field had no interest in refinance activity -- only in people who were buying homes," Middleman recalled. "Everybody wanted to refinance. Credit was really tough; it took us about six months to do each loan and the loan files were six inches thick. I had to sell, process, and cajole bankers to buy the loans once I closed them. That's how I learned the business."

Rood and Middleman talk about the lessons of the Great Financial Crisis, noting that it was preceded by a massive political push to expand homeownership. The government leaned hard on the government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac to accommodate buyers who were not prepared to own, Middleman argued. This effort to foster economically healthier neighborhoods and create generational wealth had unintended consequences.

"Pressure from the government on the GSEs to raise the homeownership level with the intention of improving neighborhoods went too far," he said, leading to foreclosures, boarded-up homes, squatters and illegal activity such as drug dealing. "It hurt the values of all the homes around them. Neighborhoods that weren’t terrible became horrible neighborhoods, and the consequences lasted 10 years."

Middleman also discusses his childhood in Philadelphia, how he caught the entrepreneurial bug, the boom-and-bust retail operation he launched as a young college grad during the U.S. Bicentennial, and his adventures in restaurants and insurance. He and Rood examine sustainable strategies to support homeownership for middle-income Americans without fueling a demand spiral that leads to price inflation; and they offer advice for new industry participants during turbulent times.

Listen to the podcast above.