Who We Are

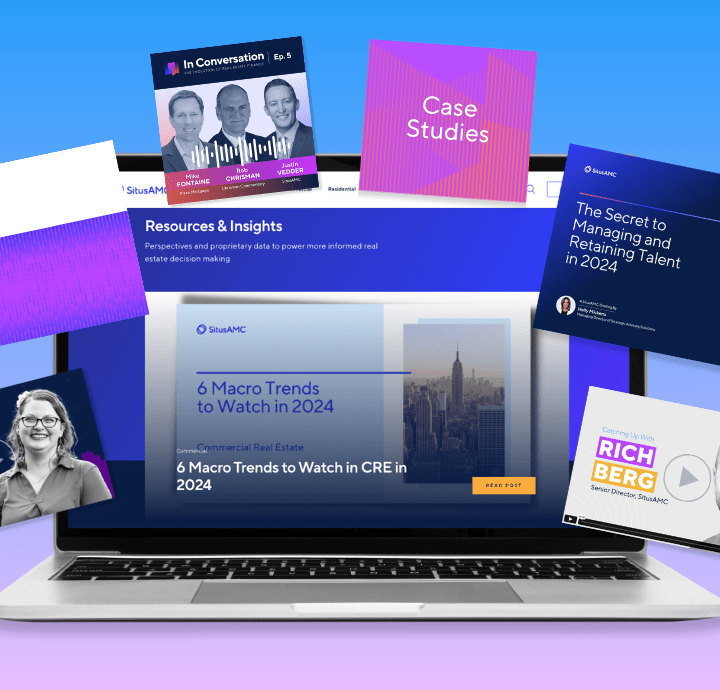

SitusAMC is trusted by the top real estate lenders and investors to support the lifecycle of their commercial and residential real estate activity. We do this through the industry’s most complete end-to-end offering, powering the origination, transaction, management and valuations of real estate debt and equity. We are trusted by top banks, private equity firms, asset managers, residential originators and servicers, CMBS/RMBS issuers, and insurance companies to identify and capture opportunities in their businesses through innovative solutions that drive operational efficiency, increase business effectiveness, and improve market agility. Explore how we can power opportunity in your business.

Commercial Real Estate Residential Real Estate

We’re transforming the way the real estate finance industry operates by bringing together top talent, innovative tech and proven services to create more efficient and transparent markets, driving exponential value for all market participants.

Our Commitments & Culture

Company News

Explore all NewsSitusAMC Named #1 U.S. CMBS, SASB & CLO Special Servicer by Volume in 2025

New York, NY – [February 9, 2026] — SitusAMC, the leading provider of commercial real estate finance solutions, announced that it has been ranked the #1 U.S.

SitusAMC Recognized for Sustainability Leadership by EcoVadis

New York, NY – (November 10, 2025) – SitusAMC, the leading provider of innovative, trusted solutions supporting the entire lifecycle of real estate finance, has once again been recognized for its commitment to sustainability with a Bronze Sustainability Rating from EcoVadis, the world’s largest and most t