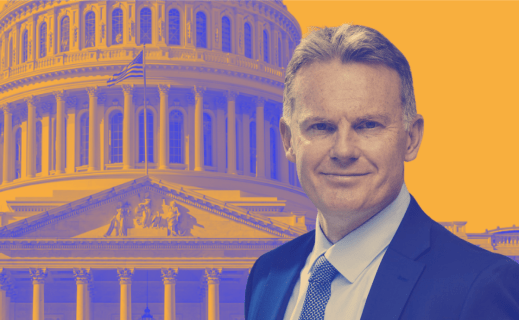

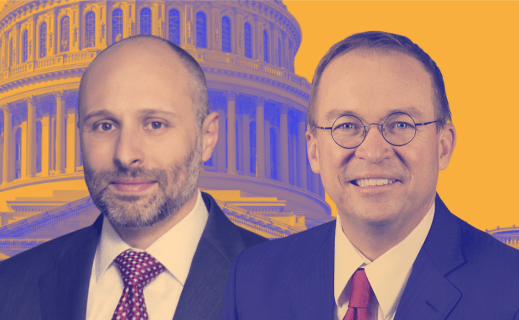

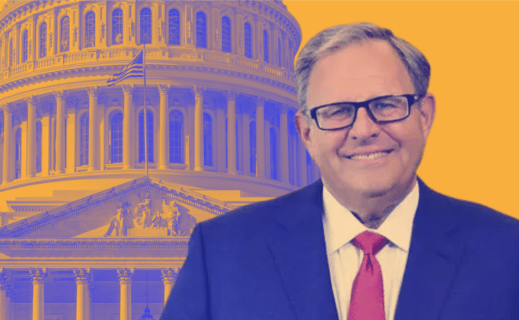

On the Hill Episode 22: Wes Iseley, Senior Managing Director, Carrington Holding Company

In this episode of "On the Hill," Tim Rood talks with Wes Iseley, Senior Managing Director, Carrington Holding Company, about his 40-year career in the mortgage industry. They discuss Iseley's journey from a Kentucky childhood to his current position leading a Top 10 GNMA Seller-Servicer-Issuer and one of largest U.S. non-bank lenders and servicers.

Rood and Iseley dive into the factors affecting the mortgage market, including 1interest rates hikes and the risk of recession. Despite recent headwinds, Iseley said he does not anticipate widespread defaults similar to what occurred during the Global Financial Crisis.

"If you look back at 2008 and the state of the servicing industry then and now, it's two different worlds," Iseley explained. "Credit quality is the highest I've ever seen. I don't think that you're going to see the wave of foreclosures everybody predicted because of the amount of equity. The 2022 (mortgage originations) might be a little more challenging. But I think we're going to have a little bit of a softer landing than some people are predicting."

In 2022, Iseley received the Five Star Lifetime Achievement Award honoring his four decades in the industry. Rood asked Iseley to explain how he got the nickname the "honey badger" in reference to his leadership style.

"You need to be tenacious and focused and stay on track," Iseley replied. "Everybody gets kind of upset about the small things, but the small things will go away. Focus on the mission and what you're trying to accomplish. If you keep people focused and communicate that vision, that's how you get ahead. The whole thing comes with trust -- your trust in your people, their trust in you."

In addition, Rood and Iseley discuss the burden that the CARES Act put on the private sector during the Covid-19 pandemic, and the Federal Housing Administration’s proposal to create a new partial claim option to help homeowners at risk of default. Under the supplemental partial claim measure, servicers could use the FHA partial claim to bring a borrower’s home loan current and reduce their monthly payments for a period of three to five years.

During the pandemic period of forbearance "the issuer still had to pay the bondholder," Iseley said. "During that whole time the nonbanks made it through. It's probably the biggest test on servicing strength to date in my 40 years. I think everybody had a plan to structure their cash, but it took a lot of ingenuity to make it through. Every time they hit the forbearance button for those 18 months, we paid the bondholder. And I think we need to solve for that in the future."

Listen to the podcast above.