Our Offering

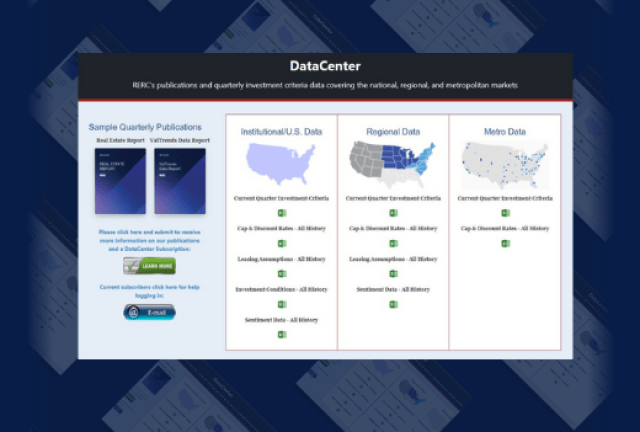

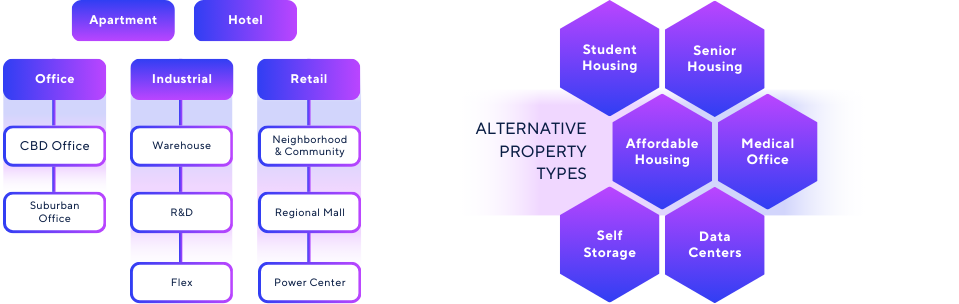

RERC Investment Criteria Data

National, Regional and metro level data covering investor sentiment on cap and discount rates, leasing assumptions, expense growth, investment conditions, the availability and discipline of capital, and verdicts on buying, selling, or holding assets among 11+ property subtypes, including niche segments like medical office, data centers and senior housing.

Subscribe Today

Our Offering

Forecast Data

Yielded from analytics of our fundamentals data, our forecasts predict near-term movements in supply and demand of the major property segments in major US markets. Such data include absorption, effective rent, vacancies, cap rates, revenue and valuation indexes.

Subscribe Today

Our Offering

Proprietary Metrics

Z-Scores, Dynamic Population Tracker, Market Ratings, volatility measures, and quality of life scores.

Subscribe Today