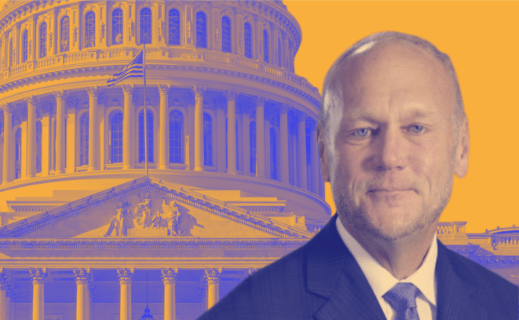

On the Hill Episode 9: Economist Mark Fleming

In this episode of On the Hill, Tim Rood, Head of Industry Relations, talks with Mark Fleming, Chief Economist, First American Financial Corporation, a leading provider of title insurance, settlement services and risk solutions for real estate transactions. They discuss the COVID-19 forbearance programs and foreclosure moratoriums, President Biden’s emphasis on increasing homeownership for minorities and first-time buyers, and the outlook for the hot U.S. housing market.

Fleming argues that the risk of pandemic delinquencies becoming widespread foreclosures is “very, very low, even for those … seriously delinquent borrowers … because everyone is sitting on massive amounts -- trillions of dollars – of housing equity.”

In addition, fundamental supply-and-demand dynamics are likely to push housing prices even higher. “By our estimation house prices are not overvalued,” Fleming said. “They may be high, but interest rates are low. Your affordability is still there and we are really holding the line on the creditworthiness of borrowers. There is a fundamental demand among Millennials – so there’s a big supply and demand imbalance. That’s what is driving prices up right now. The result is likely even more house appreciation in the next year or so, because I don’t think we can fix the supply and demand imbalance that quickly.”

Fleming leads an economics team responsible for analysis, commentary and forecasting trends in the real estate and mortgage markets. Before joining First American, he developed insights and analytical products for CoreLogic, and property valuation models at Fannie Mae. Fleming graduated from the University of Maryland with a Master of Science and a doctorate in agricultural and resource economics, and holds a Bachelor of Arts in economics from Swarthmore College. He has published research in the American Journal of Agricultural Economics and Geographic Information Sciences, and is a U.S. patent author. Fleming is frequently quoted by media including The Wall Street Journal, The New York Times, and Housing Wire and he is a regular guest on CBS, CNBC, Fox Business News and NPR.