Apartment Outlook Up As Single-Family Affordability Tumbles: ValTrends First Look Webinar

Prospects for the apartment sector may be edging up, as single-family home affordability has plummeted to a record low, according to the ValTrends First Look webinar held on April 18. Hosted by the SitusAMC Insights leadership team of Peter Muoio, PhD, and Jennifer Rasmussen, PhD, the webinar leverages proprietary data and exclusive surveys of commercial real estate (CRE) leaders to provide a forward-looking snapshot of capital and space market trends. Here are the highlights:

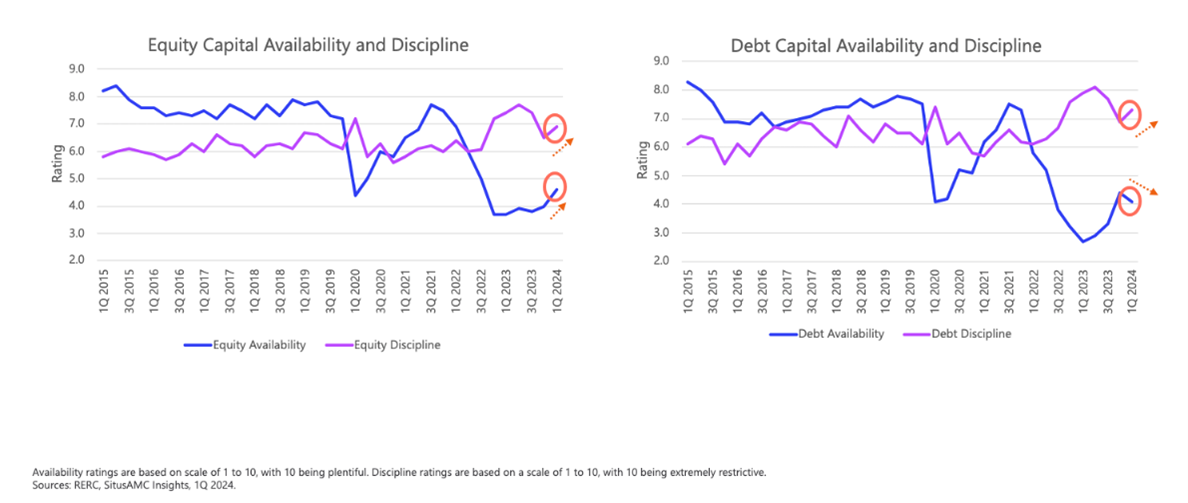

Capital Trends: The availability and discipline of equity and debt capital for CRE shows equity capital remains tight amid high interest rates, with slight easing in the first quarter. Equity underwriting standards remain very conservative. Debt availability contracted while discipline tightened.

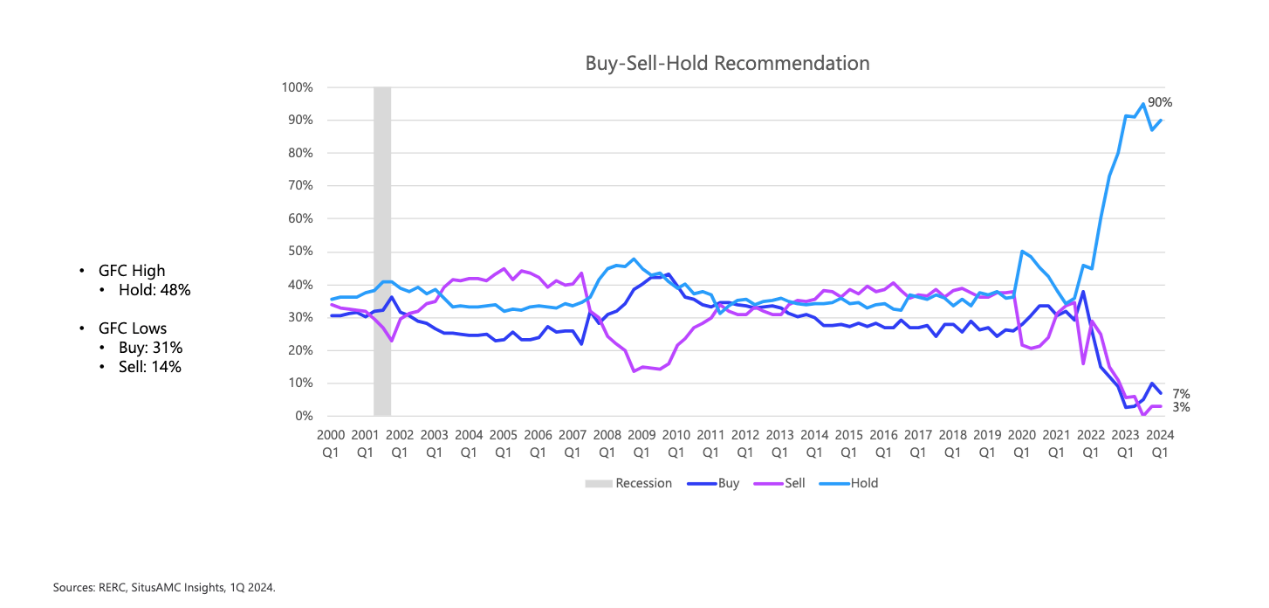

Buy, Sell, Hold: A whopping 90% of investors favor holding, with just 7% and 3% recommending buying or selling, respectively, the latest survey found. That compares to 48% of investors who favored holding during the Global Financial Crisis (GFC). "The hold recommendation persists amid all the uncertainty about high interest rates and spreads,” said Muoio.

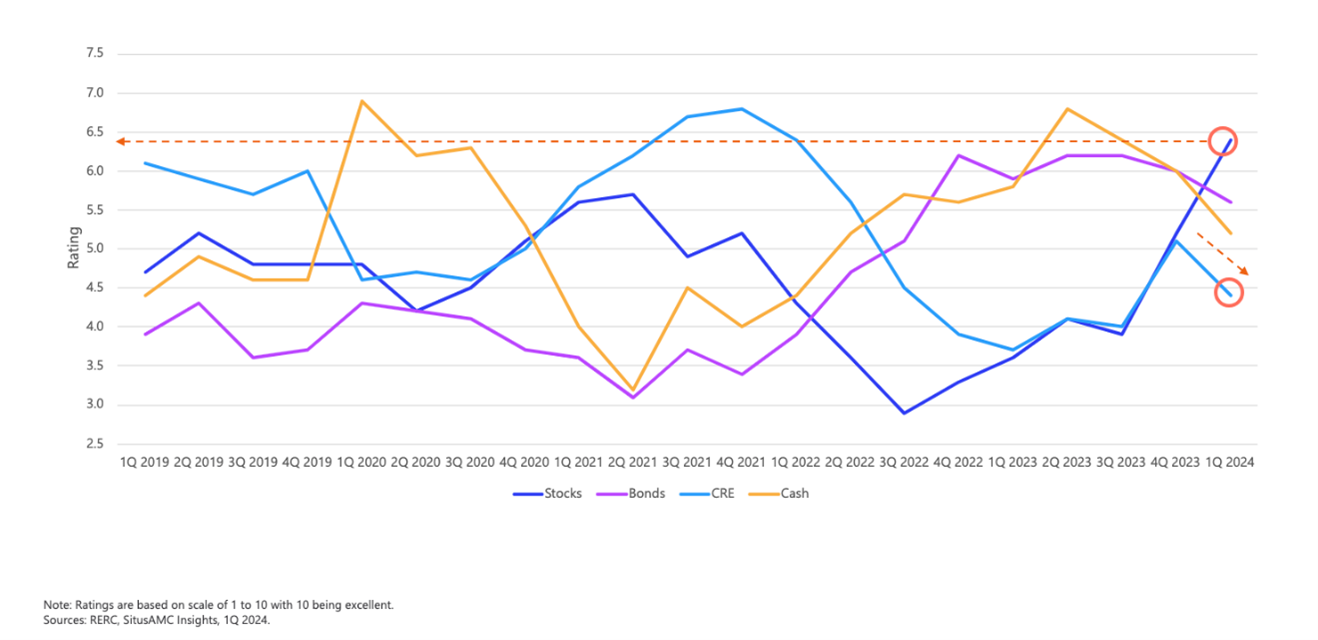

Asset Class Preferences: The SitusAMC Insights quarterly survey of investor preferences across the major asset classes finds stocks have skyrocketed to a record. That’s the highest since the survey began in 2007.

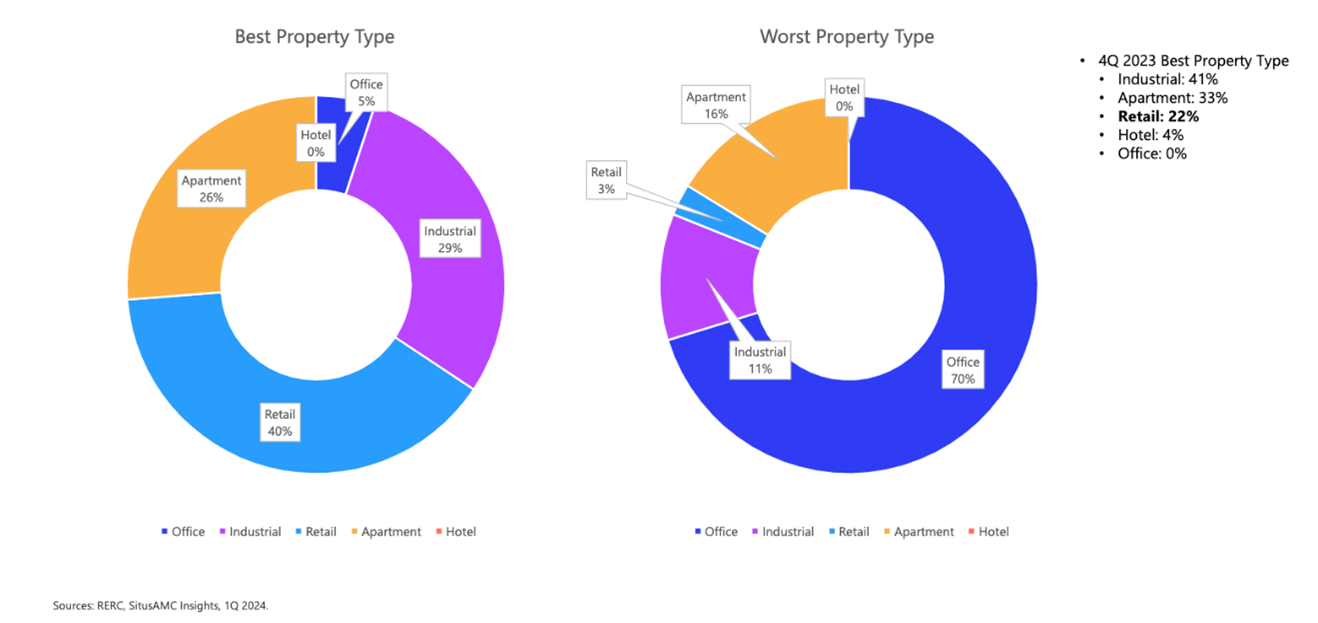

Property-Type Preferences: Retail is the new darling -- named best property type by 40% of investors in the latest quarterly survey, up from 22% in 4Q 2023. That compares to 29% of investors who named industrial the top sector, and 26% who chose apartment. “Not that long ago retail was getting hammered by COVID-19 and certainly e-retail – and now we see a huge jump in investors thinking about retail,” Muoio said. Investors remain pessimistic about office, named the worst property type by 70% of survey respondents.

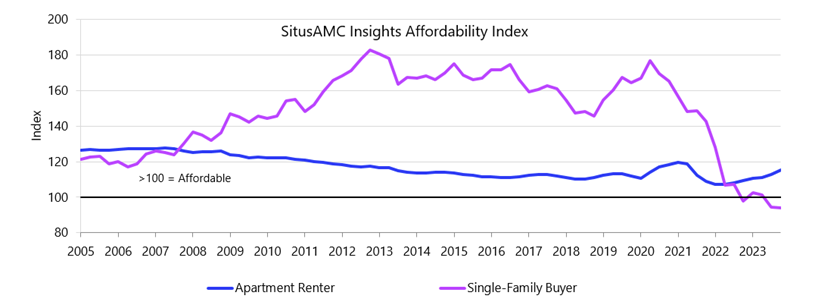

Sector Highlights: Apartment vacancy is up 20 basis points and rents are down 1.6% quarter-over-quarter, the most recent fundamentals from Reis data show. SitusAMC projects vacancies to reach 6% as rents contract in 2024. But demand drivers point to a stronger long-term outlook: The SitusAMC Insights Affordability Index dshows single-family affordability tumbled 47% from the pandemic peak to the lowest level on record. The rapid rise in mortgage rates and stubbornly high prices have contributed to plummeting single-family affordability. Meanwhile, apartment affordability increased for the first time in nearly two years.

In the latest quarter, however, rents were down year over year for Class A, B and C multifamily properties, because of increased supply. “We are also seeing a correction from those red-hot rent gains of 2021 and 2022,” Rasmussen said.

Despite the narrative of a flight to quality, Class A office fundamentals are being buffeted by new supply and weak demand. Overall office vacancies rose 40 basis points and rents fell 2.3% quarter-over-quarter. "Office weakness is expected to persist, with vacancies projected to eclipse 20% through 2027,” Rasmussen said. NOI is expected to be negative over the next few years. Office transactions are down more than 90% since the Fed began tightening in 2022.

Industrial is seeing higher vacancies in the warehouse and flex/R&D subtypes, but overall sector performance is solid. “Vacancies remained at healthy levels in both sub-segments at about 5% rent growth,” Rasmussen said, adding that Southern California is struggling.

Retail has remained relatively steady with stable occupancy, mostly positive lease trade-outs, and modest increases to market and contract rents. “New supply has been constrained due to difficulty in getting developments to pencil out with the current market rents,” Rasmussen said. “The limited supply coming online tends to be focused on redevelopment into mixed-use and free-standing, single-asset retail. Over the next few years, we expect positive but relatively slow rent growth, with generally stable supply and demand dynamics.”

View the ValTrends First Look webinar presentation here. Learn more about SitusAMC’s research and data offerings on our website.