Originators Should Look to Mitigate Risk As Consumer Finances Deteriorate

Consumer finances are deteriorating, and the U.S. is likely to see a pullback from recent strong spending levels as Americans deplete pandemic-era savings, according to a new analysis by SitusAMC Insights. That could put more pressure on the single-family housing market, already stymied by stubbornly high prices and escalating mortgage interest rates.

"Consumer spending comprises 68% of U.S. economic activity, so the financial health of American households is integral to the economy and housing market," said Peter Muoio, PhD, Head of SitusAMC Insights. "We believe that people may soon tap into the stockpile of cash and cash equivalents they built up during the Covid-19 pandemic. But because of those savings, the consumer will likely cut spending gradually over time, instead of running into a wall."

The trend could mean more challenges for the economy and potential home buyers, who are already hampered by lean inventories, high prices and mortgage rates heading toward 8%. In September, the median existing home price hit $394,300 on a seasonally adjusted basis -- a 40% increase since the beginning of the pandemic, according to the National Association of Realtors. To afford the median-priced home, buyers need to earn $114,627 annually, according to a Redfin analysis.

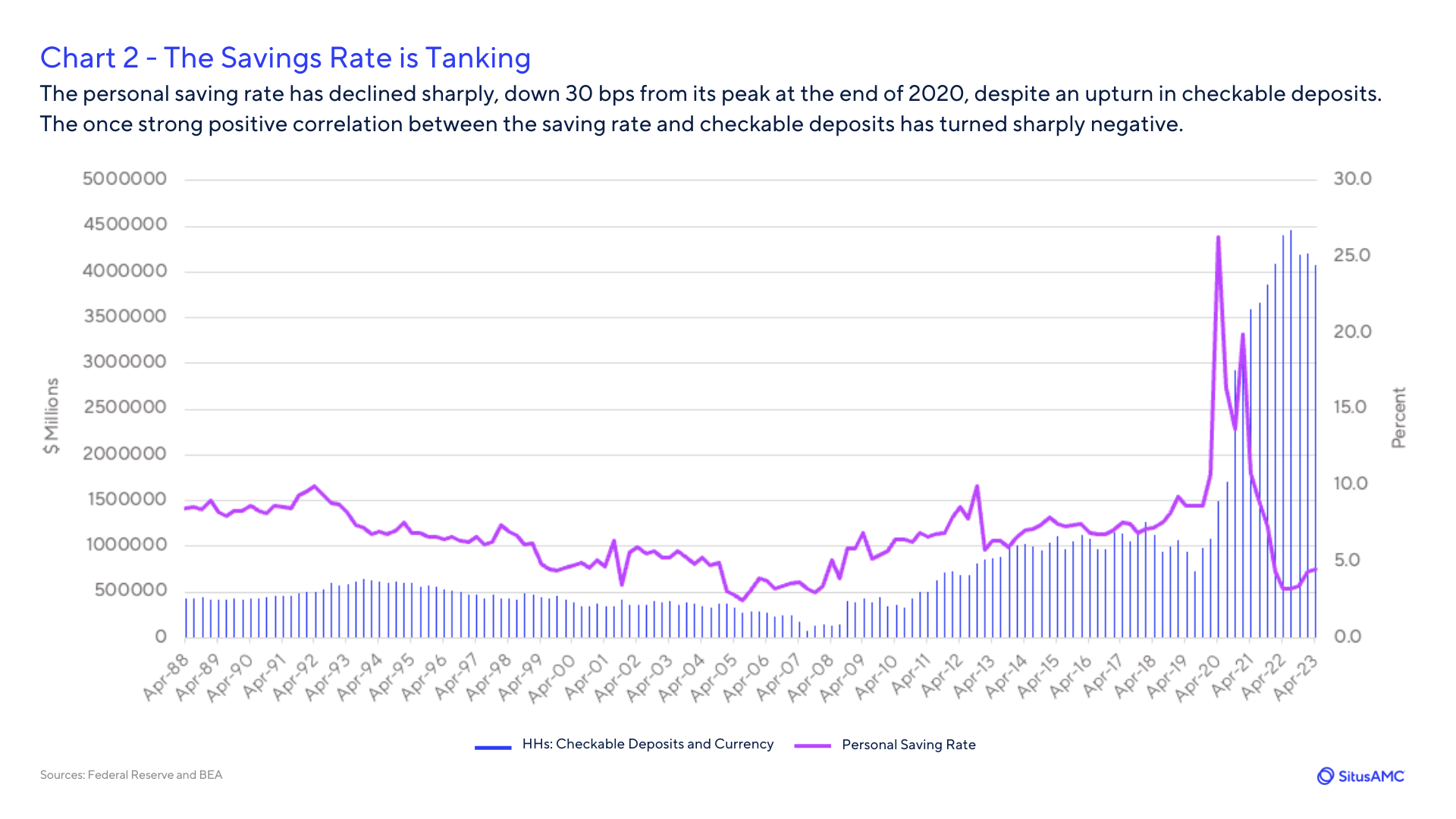

"Some observers say concerns about consumer finances are overblown because of the huge surge in checkable deposits and money market funds," said Jen Rasmussen, PhD, Vice President, SitusAMC Insights. "But our analysis found a number of factors could combine to diminish that cushion."

Here is a view of U.S. household financial health in seven charts.

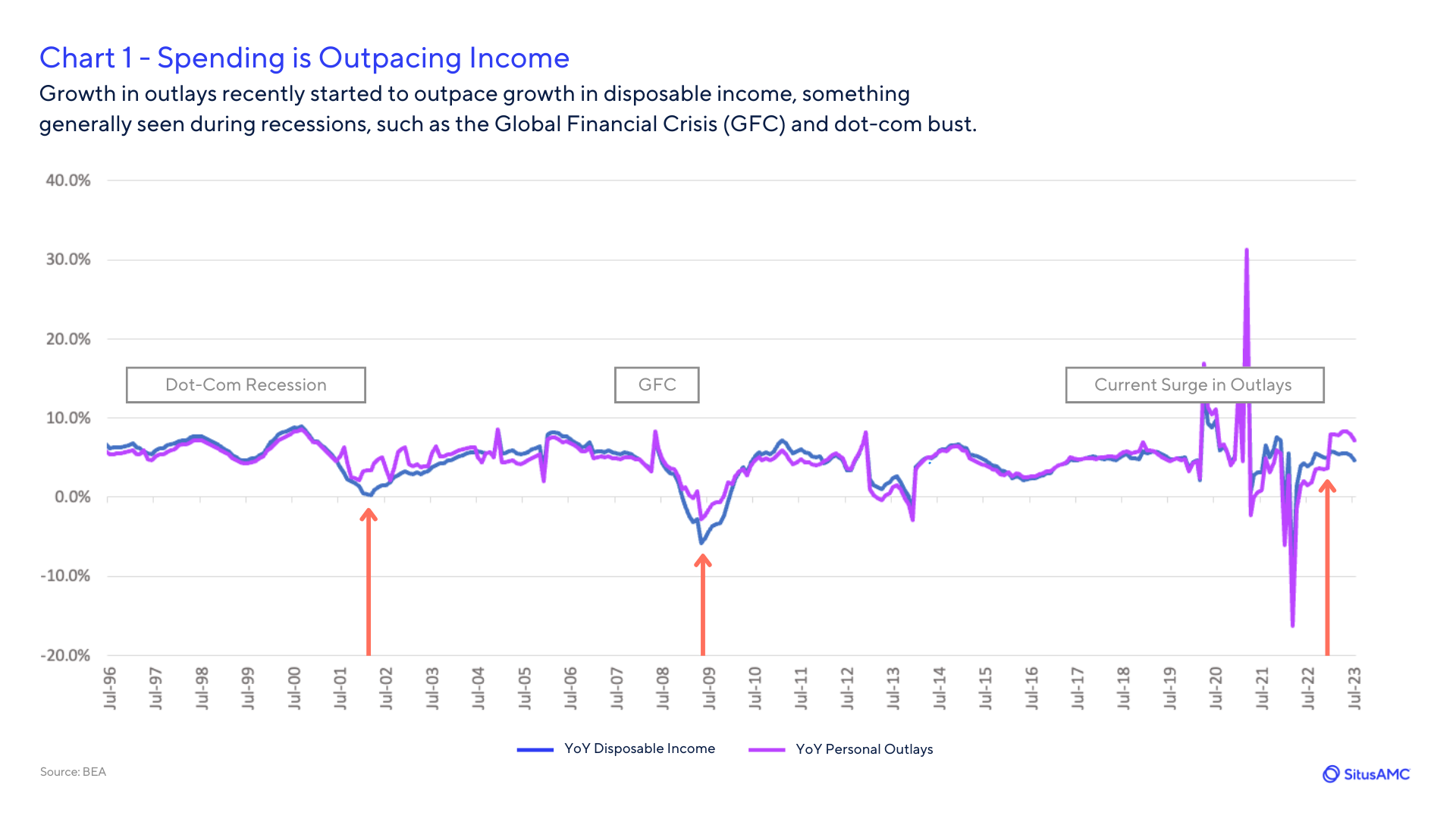

Chart 1: Spending is outpacing income. Growth in outlays recently started to outpace growth in disposable income, something generally seen during recessions, such as the Global Financial Crisis (GFC) and dot-com bust.

Chart 2: The savings rate is tanking. The personal saving rate has declined sharply, down 30 bps from its peak at the end of 2020, despite an upturn in checkable deposits. The once strong positive correlation between the saving rate and checkable deposits has turned sharply negative.

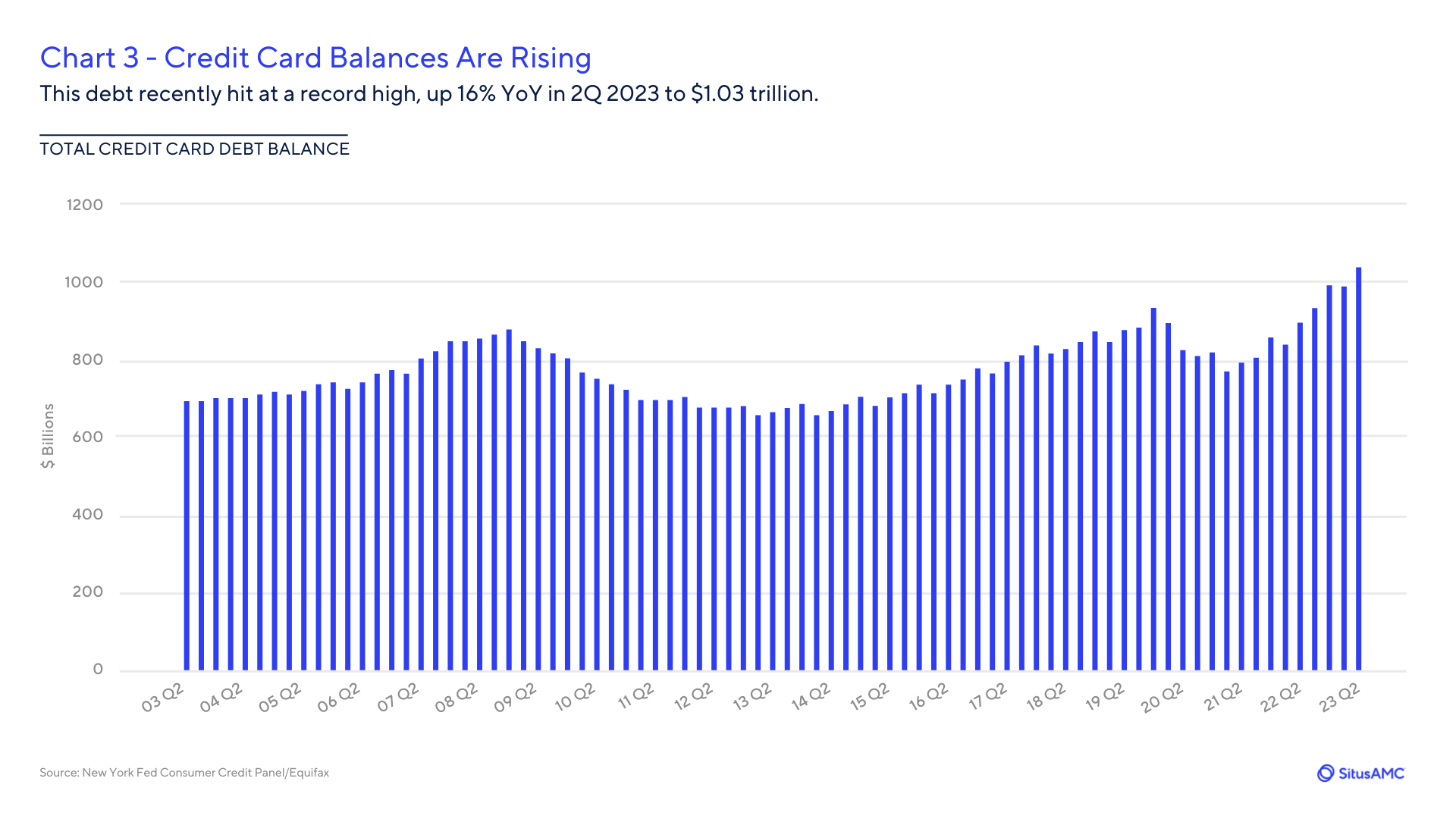

Chart 3: Credit card balances are rising. This debt recently hit at a record high, up 16% YoY in 2Q 2023 to $1.03 trillion.

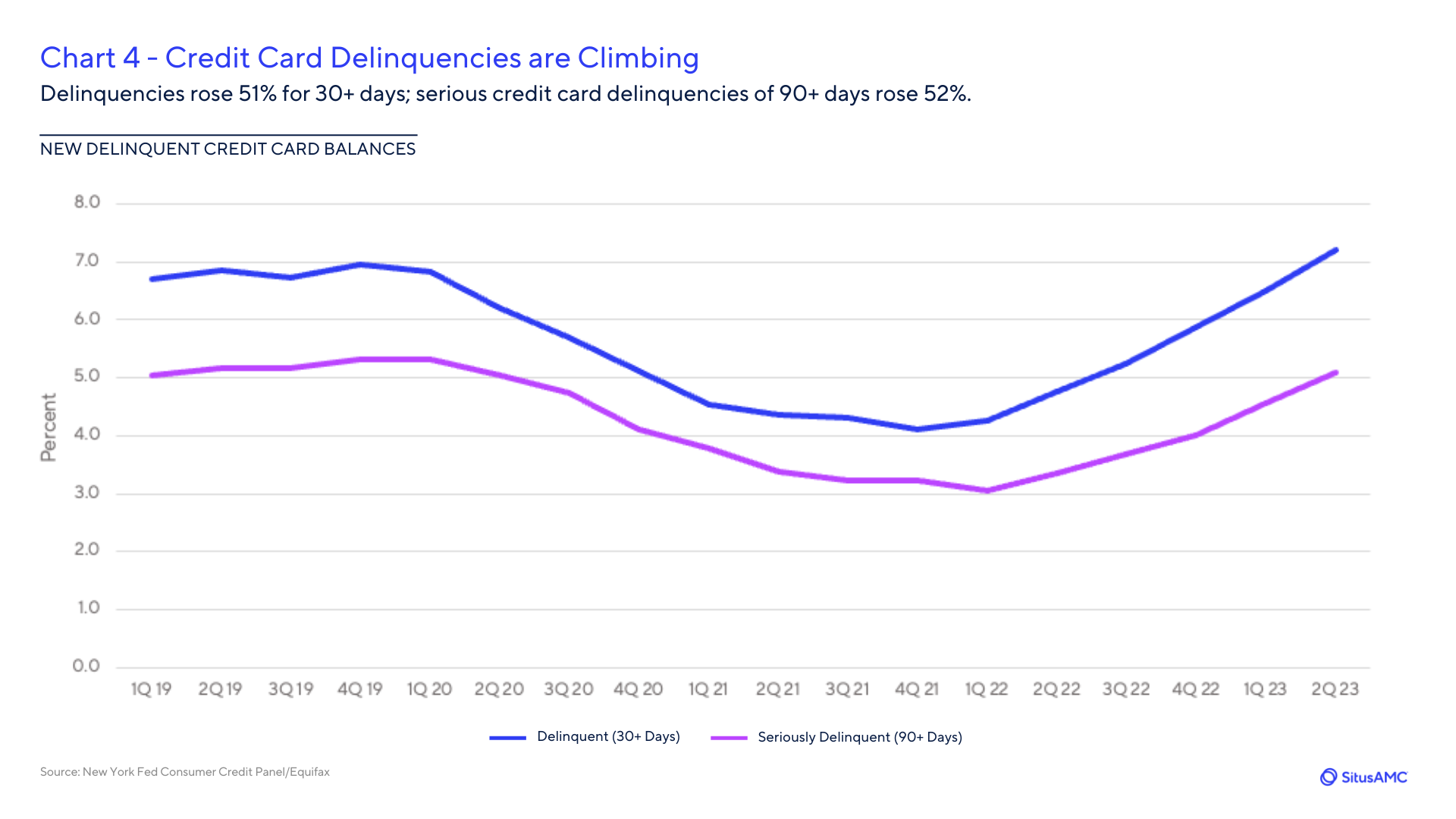

Chart 4: Credit card delinquencies are climbing. Delinquencies rose 51% for 30+ days; serious credit card delinquencies of 90+ days rose 52%.

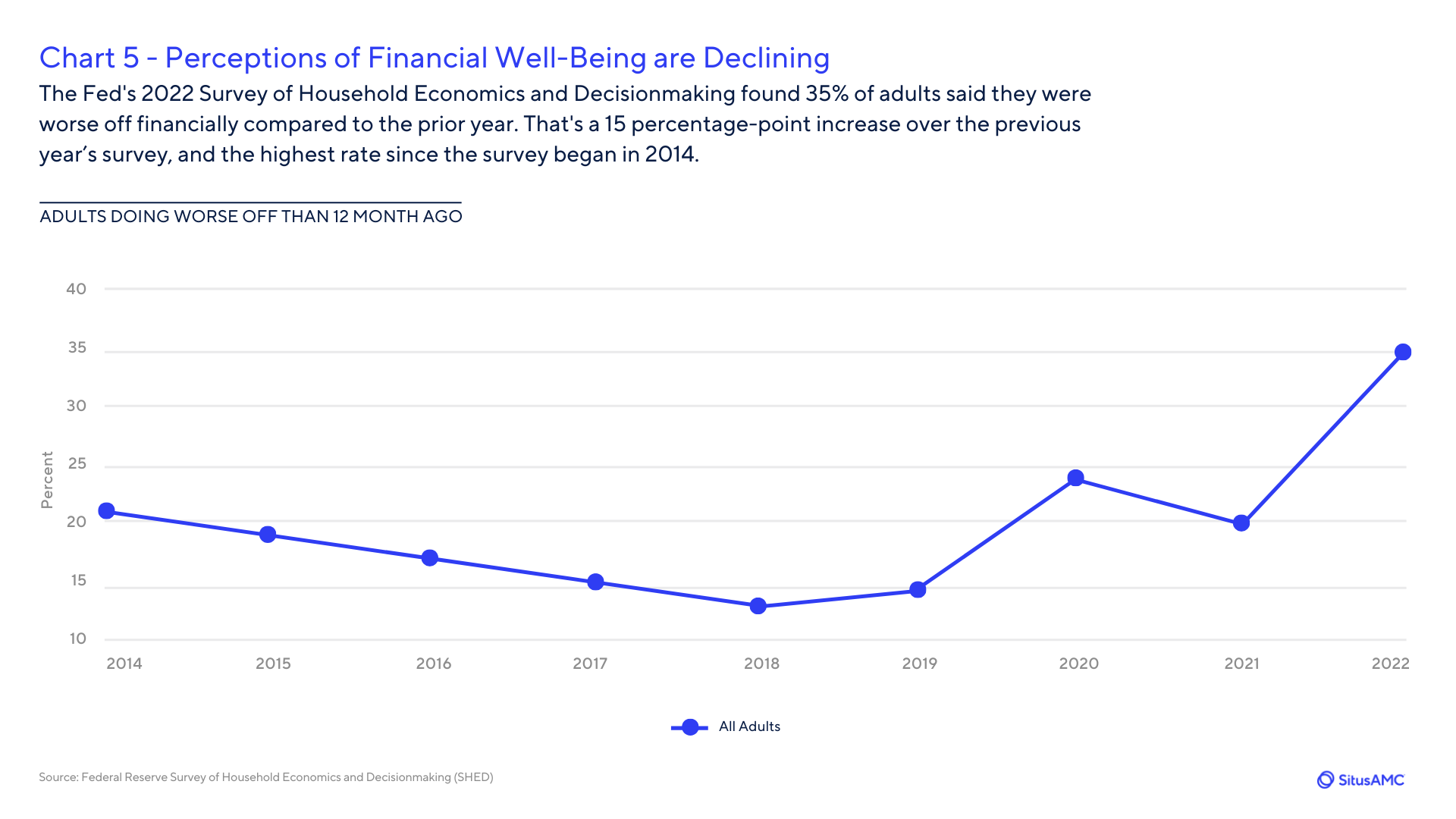

Chart 5: Perceptions of financial well-being are declining. The Fed's 2022 Survey of Household Economics and Decisionmaking found 35% of adults said they were worse off financially compared to the prior year. That's a 15 percentage-point increase over the previous year’s survey, and the highest rate since the survey began in 2014.

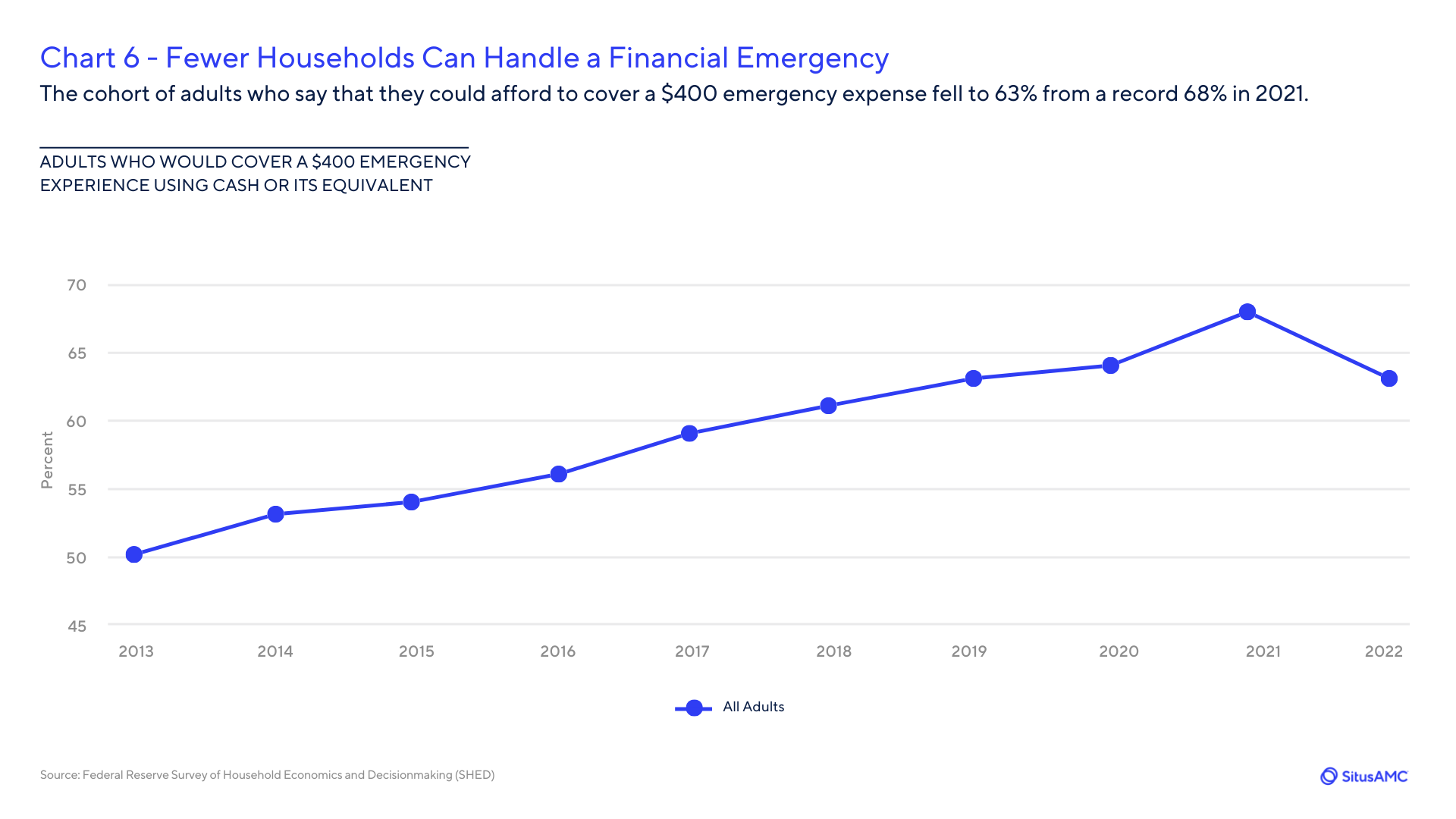

Chart 6: Fewer households can handle a financial emergency. The cohort of adults who say that they could afford to cover a $400 emergency expense fell to 63% from a record 68% in 2021.

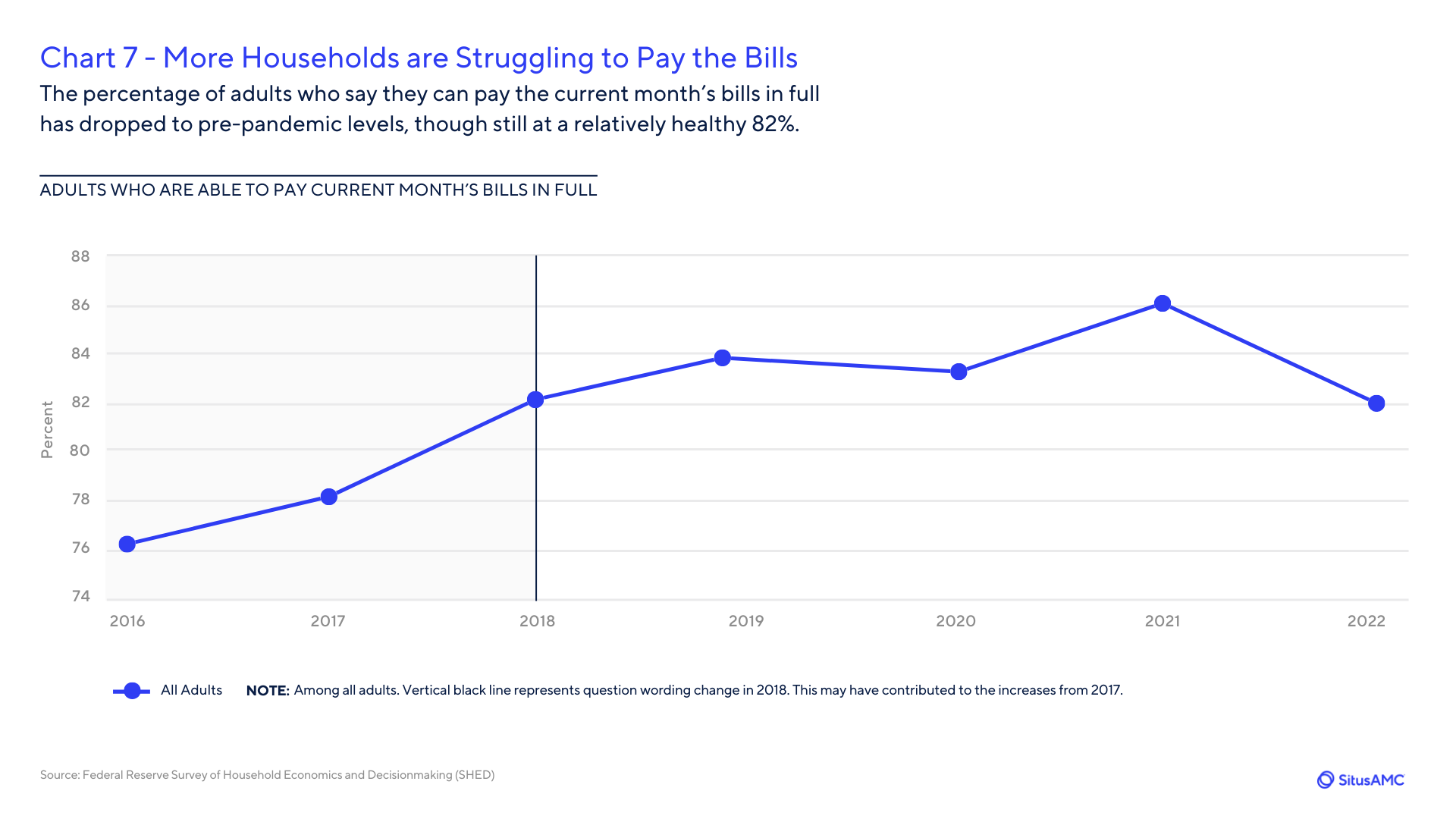

Chart 7: More households are struggling to pay the bills. The percentage of adults who say they can pay the current month’s bills in full has dropped to pre-pandemic levels, though still at a relatively healthy 82%.

When consumers’ finances are faltering, it can lead to fraud in the mortgage origination process, and subsequent buybacks for mortgage lenders, noted Justin Vedder, president of Securent Risk and Insurance Services, a SitusAMC subsidiary.

“As consumers’ finances deteriorate, we tend to see a rise in fraud related to income, bank statements and employment verification, among other issues, that can lead to repurchase demands,” Vedder said. “Home buyers who are stretched thin also make mistakes that aren’t intentionally fraudulent but still create buybacks, such as changing employers and being unemployed for a few weeks or taking out a car loan before closing without informing the lender.”

Mortgage originators may want to consider a loan defect insurance solution such as Securent, which protects primary and secondary mortgage participants against risk associated with defects introduced in the loan manufacturing process. Learn more about Securent at www.SecurentRisk.com