Debt & Equity Briefing 3Q 2025: Market Sees Rising Activity, Optimism

In the third quarter of 2025, commercial real estate (CRE) experienced growing activity and cautious optimism, tempered by ongoing uncertainty and sector-specific challenges. Net operating income (NOI) drove changes in valuation, while capital market and space market assumptions remained mostly stable across property types and submarkets.

That’s according to SitusAMC’s CRE Debt & Equity Briefing, which leverages the boots-on-the-ground perspective of the firm's professionals across the organization, offering investors real-time market insights ahead of many traditional CRE data sources.

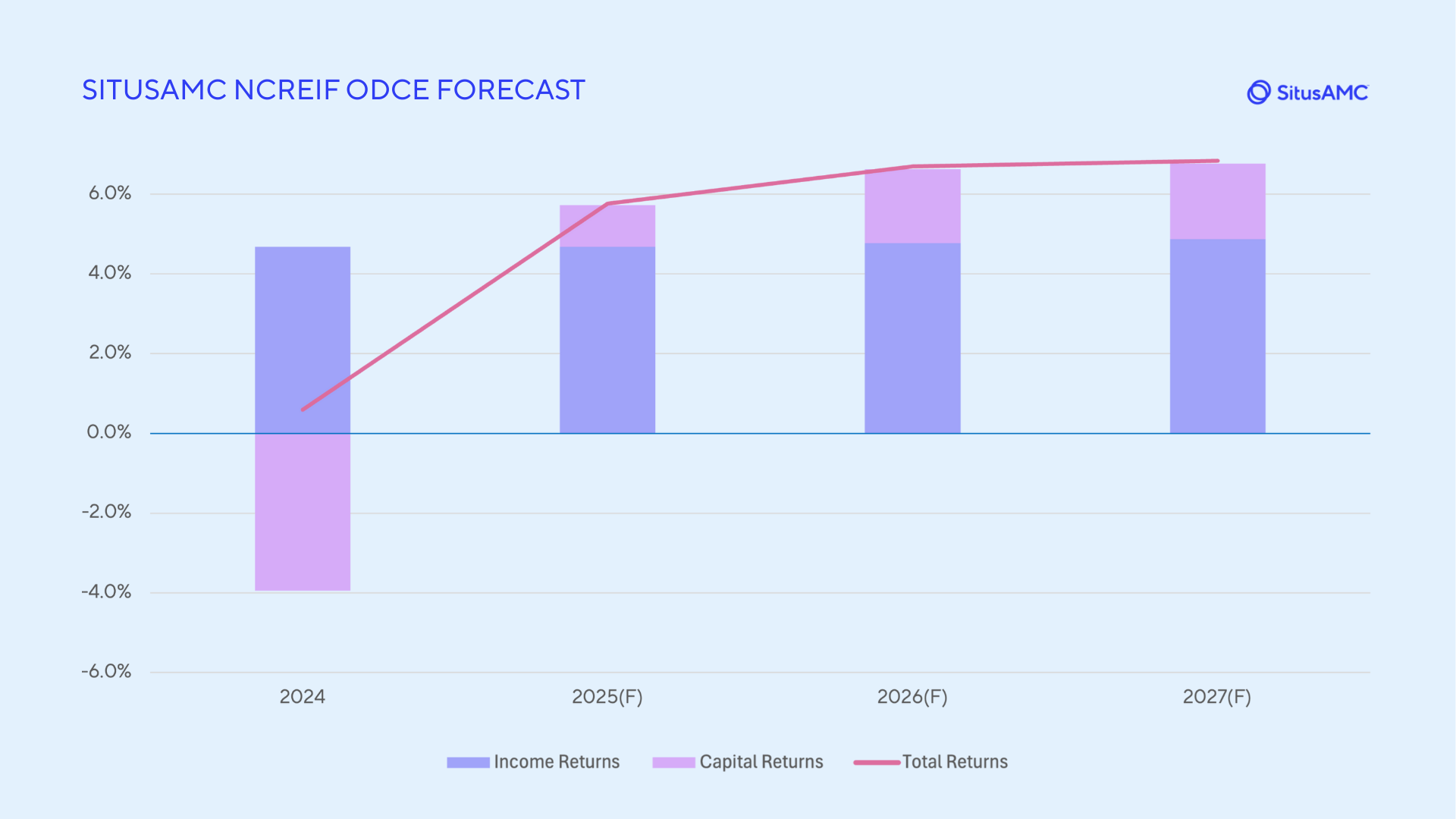

As of mid-September, third-quarter fund-level total returns were expected to fall between 1% and 1.25%, reflecting the income return, though there was notable dispersion among funds. SitusAMC’s NCREIF ODCE forecast shows annual total returns reaching 6% in 2025 and further increasing to 7% by 2027, driven by appreciation.

For servicing and asset management, multifamily and office assets are requiring close monitoring, while retail and hospitality present selective opportunities. The debt and securitization markets are showing signs of recovery, and operational demands are driving growth in staffing and support services. Here are the key Briefing highlights.

Property-Type Valuation Trends

• Office momentum is improving, particularly in trophy assets in coastal cities.

• Industrial leasing is slowing, though investor interest remains competitive.

• Retail is showing resilience, with high occupancies, mixed expense trends and robust investor competition.

• Apartment vacancies are set to decline, and year-over-year rent growth remains positive; and self-storage appears stable following rent declines.

Office leasing activity is showing signs of improvement, particularly in high-quality, trophy assets. The Bay Area is experiencing renewed interest, with notable leasing momentum driven by AI startups and expanding tech firms. Appraisers are cautiously optimistic, even for assets in weaker submarkets, suggesting potential rent growth in later years.

New York City has surpassed pre-pandemic office visit levels, and Miami is close behind, signaling a national trend of gradual return-to-office. San Francisco and Silicon Valley are experiencing rent growth even in less favorable submarkets, though there is some bifurcation in rent performance between premium and lower-class assets. However, national office vacancy continues to rise, especially among Class B and C properties, with no signs of reversal yet. Life science properties continue to struggle in the wake of market uncertainty, very little leasing activity and limited venture capital funding.

Industrial leasing activity from tenants is slowing significantly, leading to a flattening of the rent growth. While certain markets, such as those in Southern California, continue to experience declining market rents -- albeit still higher than in-place contract rents for any short weighted average lease term (WALT) properties -- the broader industrial sector remains a high-conviction property sector. Investor interest remains competitive, particularly in core markets where pricing has remained steady over recent quarters.

Additionally, a reduction in new supply is expected to drive accelerated rent growth in the future, attracting opportunistic investors aiming to capitalize on this trend. Vacancy rates have been gradually increasing since mid-2022, though not at a significant pace, and this trend continued into the third quarter. Construction activity has declined sharply, with most new developments now concentrated in build-to-suit projects rather than speculative builds. Spec developments that do exist are taking longer to lease, as large corporate users reassess and reallocate their space needs. Despite these short-term challenges, the long-term outlook for industrial remains positive, with expectations that occupancy will stabilize and begin to improve, supporting future rent growth and asset value appreciation.

Retail continues to demonstrate resilience despite macroeconomic uncertainties, including tariff concerns and mixed consumer sentiment. National occupancy is high at around 95%, and construction activity remains subdued. While leasing volume and asking rents have declined, this is largely attributed to a shortage of desirable Class A/B+ space, with subprime space lingering on the market. Grocery-anchored centers are performing particularly well, with strong leasing and backfilling activity. Expense trends are mixed, with increases in payroll and general and administrative costs offset by declines in insurance costs due to heightened market competition.

Investment activity is robust as retail is viewed as a relatively safe asset class. In the first eight months of the year, 28 deals over $100 million have closed, 11 of which exceeded $200 million. REITs remain active, citing strong fundamentals and the cost advantage of acquiring existing centers versus new development. Tariff-related uncertainty is a key watchpoint, especially for niche retailers less able to absorb cost increases. In addition, large retailers like Walmart and Costco are planning to spread increased costs across product lines.

Multifamily vacancy rates, which had previously trended upward, have flattened in recent periods and are projected to decline over the next two to three quarters. Although summer leasing activity was softer than usual, year-over-year rent growth remains positive. Property managers appear to be prioritizing occupancy, which is expected to support stronger rent growth as the supply pipeline dries up. Current market-level rent growth assumptions generally remain flat, though variations exist by market.

The Bay Area is leading in rent growth recovery, with double-digit projections over the next year. Underwriters are building in more aggressive rent growth expectations over the first few years, especially in Sunbelt markets, including Denver, Phoenix and Austin. These markets are absorbing high supply well, though concessions remain elevated as properties compete for occupancy.

Renovated assets in high-supply markets have underperformed, often requiring similar concessions as new builds. In contrast, Class B and C assets have performed strongly due to limited housing supply and a dry future pipeline, allowing for rent increases while maintaining high occupancy. On the expense side, insurance costs have improved significantly, reversing last year’s sharp increases and offering budget relief.

Sales volume is beginning to pick up but remains below historical norms, with borrowing costs continuing to constrain transaction activity. Investors are focused on acquiring assets below replacement cost with the expectation that tightening supply will enable rent growth over the next two to five years. Overall, values remained stable in the third quarter, with few catalysts for material appreciation outside of standout markets like San Francisco and Northern Virginia, where strong in-place rent growth is driving value gains.

The self-storage sector has shown signs of stability following a period of declining face rents. While REIT leasing updates are pending at this writing, anecdotal evidence suggests underwhelming performance during the summer, largely due to a slump in the housing market. Despite this, fundamentals remain favorable in select regions. High-barrier markets such as the Northeast and Chicago are experiencing stronger effective gross income growth. Meanwhile, the Sunbelt is working through a recent surge in supply. New construction has slowed significantly due to high interest rates and steel tariffs, reinforcing the sector’s underlying strength moving forward.

Servicing, Advisory & Asset Management Trends

• Deal flow is expected to grow through year-end despite elevated uncertainty, as many new market participants need to deploy capital, driving staffing and resource needs.

• Private equity funds anticipate tapping into IRA/401(k) and defined pension plan capital -- a roughly $12.5 trillion market. The trend is elevating the need for fiduciary oversight, investor education and careful asset and portfolio management.

• Lenders and B-piece buyers are cautious about multifamily amid rising delinquencies, with greater emphasis on financial diligence and regulatory compliance.

On the originations side, deal flow is increasing in new originations, with a lot of new shops needing to deploy capital despite elevated uncertainty in the markets. Deal volume remains steady across CMBS, balance sheet, SASB and large portfolios, with expectations for continued new origination volume growth through year-end.

Staffing and resource needs are rising in response to new debt funds and banks entering the CRE space. There should be significant growth in third-party staffing operations over the next year as outsourcing has become increasingly viewed as a strategic advantage, contributing to revenue and operational flexibility.

On the asset management side, markets are very competitive pricing-wise. There is a robust amount of dry powder waiting to be deployed, with asset managers eager to put their money to work. Our overall view is that the economy is still relatively healthy; interest rates are expected to come down over the remainder of the year; and transaction volumes should pick up. SitusAMC is closely monitoring investor risks associated with President Trump’s recent executive order that opens up the doors for retirement plans to invest in private equity, cryptocurrency, real estate and other alternative assets. As the likelihood rises that private equity funds will tap into IRA/401(k) and defined pension plans (a roughly $12.5 trillion market), the need for fiduciary oversight, investor education and careful asset and portfolio management to manage the risks also grows.

Multifamily delinquency is a focal point, with heightened caution among clients (lenders and B-piece buyers) and the implementation of more rigorous underwriting practices, including detailed lease audits and income verification. Value challenges persist due to limited market trades, making cap rate determination difficult. The scrutiny not only applies to lower-class properties, but also newly renovated properties for which investors are expecting a large pop in rents.

Financial diligence and regulatory compliance are receiving increased attention, especially regarding multifamily assets. There is a focus on tracking the flow of funds, construction expenditures and reserve releases, alongside managing REO portfolios and supporting litigation through forensic accounting. Banks are navigating challenges in managing larger REO portfolios and ensuring appropriate internal controls.

There are persistent issues in the office sector and an uptick in multifamily distress, particularly among older Class C assets. Some repositioning efforts are falling short, and while New York’s office market shows signs of recovery, looming 2026 and 2027 maturities pose ongoing risks, as do similar concerns in Chicago and other major markets. Retail remains robust except for enclosed malls, and hospitality is identified as an area with potential for increased special servicing activity.

Debt Valuation & Securitization Trends

• Bond spreads remain tight and loan spreads have stabilized.

• Policy questions and mixed macroeconomic signals continue to drive uncertainty.

• Securitization activity is surging, with a shift toward smaller deal sizes.

Debt markets are somewhat rosier, with bond spreads remaining tight, and loan spreads having stabilized after previous volatility. Several of our clients are actively seeking to grow their portfolios, focusing on senior transitional debt as opposed to stabilized loans and subordinate debt. New fund formation appears to be accelerating, suggesting renewed market momentum.

However, macroeconomic uncertainty persists, driven by policy questions such as tariffs and conflicting signals from employment and inflation data. The juxtaposition of weak employment figures and elevated inflation has revived concerns about stagflation, complicating interest rate decisions for policymakers. While uncertainty has eased slightly, it remains elevated, and market participants continue to monitor these developments closely.

Securitization trends indicate a shift toward smaller deal sizes, with billion-dollar conduit transactions becoming rare. The market is seeing a surge in activity, particularly in the CLO space, with first-time issuers entering due to attractive market conditions. The pipeline is expected to remain robust, with many deals targeting year-end and early January closings.

Explore more of SitusAMC’s resources and insights on our website. Learn more about SitusAMC research, analytical tools, and data products here.

The Latest from SitusAMC

ValTrends – October 16, 2025 at 2pm ET

Register for our next “ValTrends First Look” webinar, offering a forward-looking snapshot of the quarter ahead. Register here to attend.

Real Estate Finance In Focus: Q&A with CEO Michael Franco

SitusAMC Chief Executive Michael Franco recently spoke about his expectations for CRE finance in the year ahead. https://www.situsamc.com/resources-insights/videos/real-estate-finance-focus-qa-michael-franco

Rate-Cut Expectations and Sector Divergence Drive CRE in 2Q 2025: SitusAMC Webinar

Explore how interest-rate expectations, valuation spreads and sector-level fundamentals are shaping the CRE outlook in the highlights from our recent webinar.

https://www.situsamc.com/resources-insights/articles/rate-cut-expectations-and-sector-divergence-drive-cre-2q-2025-situsamc

Why U.S. Securitizations Must Address EU Article 7 Reporting

Learn why sponsors courting European bond investors must meet Article 7 transparency reporting standards. https://www.situsamc.com/resources-insights/articles/courting-european-bond-investors-why-us-securitizations-must-address-eu