Debt & Equity Briefing 2Q 2025: Investors Await Impact of Macroeconomic Trends

The commercial real estate (CRE) market is holding steady as many participants sit on the sidelines, waiting to understand how macroeconomic trends will affect the business before making decisions. SitusAMC’s CRE Debt & Equity Briefing leverages the boots-on-the-ground perspective of our professionals across the organization, offering investors real-time market insights ahead of many traditional CRE data sources. Here are the trends we’re seeing in 2Q 2025.

Real Estate Valuation Trends

- Valuations remain mostly flat due to economic and political uncertainty, with investors taking a wait-and-see stance.

- Industrial and retail sectors may be most influenced by tariff developments, though markets have stabilized post-announcement.

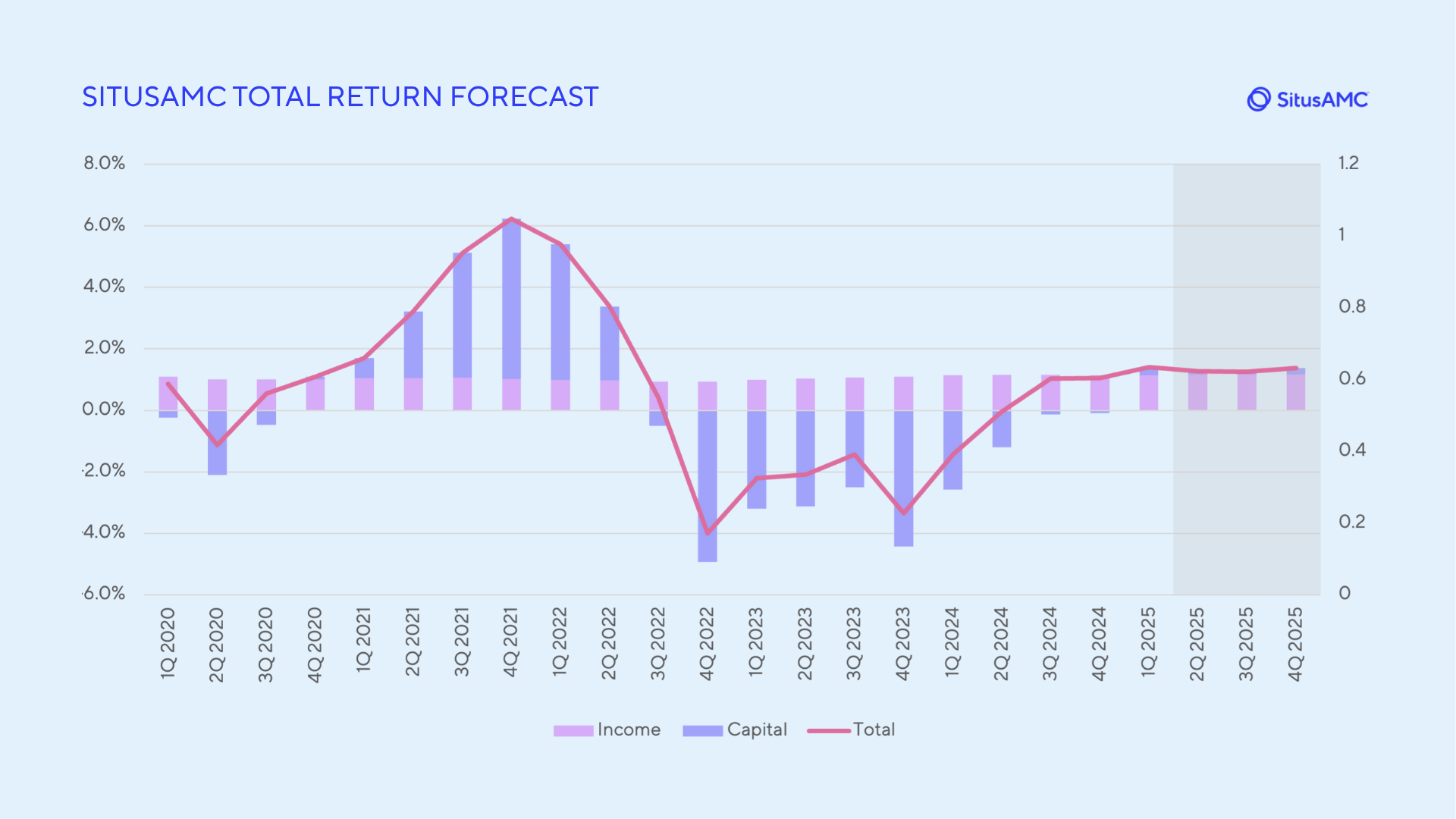

- Moderate income returns and limited appreciation expected; debt pricing influenced by fluctuations in the 10-year Treasury.

Valuations have moved little in response to economic and political uncertainty, with investors taking a wait-and-see approach. With the CRE market in limbo, market participants are looking to investor segment allocations to guide where valuations may ultimately trend, especially in the industrial and retail sectors, which could be most influenced by tariffs. Nevertheless, it is possible the tariffs are being used as more of a negotiating tactic as many industrial-specific stocks have returned to pre-tariff announcement values.

Continued moderate income returns and flat-to-slightly positive appreciation are expected. The 10-year Treasury hovering around 4.5% could eliminate significant debt mark-to-market drag. However, shifts in the 10-year rate make the debt market a moving target. While returns and valuations vary by sector and metro, most investors are expecting short-term headwinds but are hopeful of expectations for future rent growth.

Property-Specific Valuation Trends

- Apartment values are stable with muted rent growth; oversupply challenges persist, especially in the Sunbelt.

- Industrial valuations are flat to slightly up; deals continue to close despite tariffs, driven by capital deployment pressure.

- Retail fundamentals remain solid, but a scarcity of core assets and possible retailer bankruptcies pose risks.

- Office performance is highly market-dependent; leasing improves in strong RTO markets, but Class B/C still lags.

- Self-storage valuations are stable with stronger performance in infill markets; peak leasing season and capital allocation are key factors.

Apartment valuations are flat to slightly up with a competitive market helping to bolster property values. Investment rates have remained relatively stagnant, suggesting the latest price discovery seems to support current rates. Rent growth is much more muted this quarter as many markets are still working through oversupply and seasonality. The Midwest and Northeast regions have fared better with fewer previous supply additions. The Sunbelt, in particular, is plagued with oversupply. But as construction costs rise and new development slows, there is optimism for future rent growth amid positive absorption and improved occupancy.

Industrial valuations are flat to slightly positive. Deals are closing with pricing similar to the first quarter in core and value-add properties. Deals that were underwritten before the tariff announcement on April 2 are closing rather than being retraded or dropped, indicating that tariffs are not hampering the segment so far. Fundamentals are mostly flat from the previous quarter, with some general concerns surrounding the softer markets in Southern California. The economic uncertainty in the sector coincides with massive amounts of dry powder and funds nearing the end of their investment period. This gives a “use it or lose it” pressure to deploy capital into the industrial space. Despite short-term concerns, investors make decisions based on the market in the long-term and many still deem industrial an attractive sector.

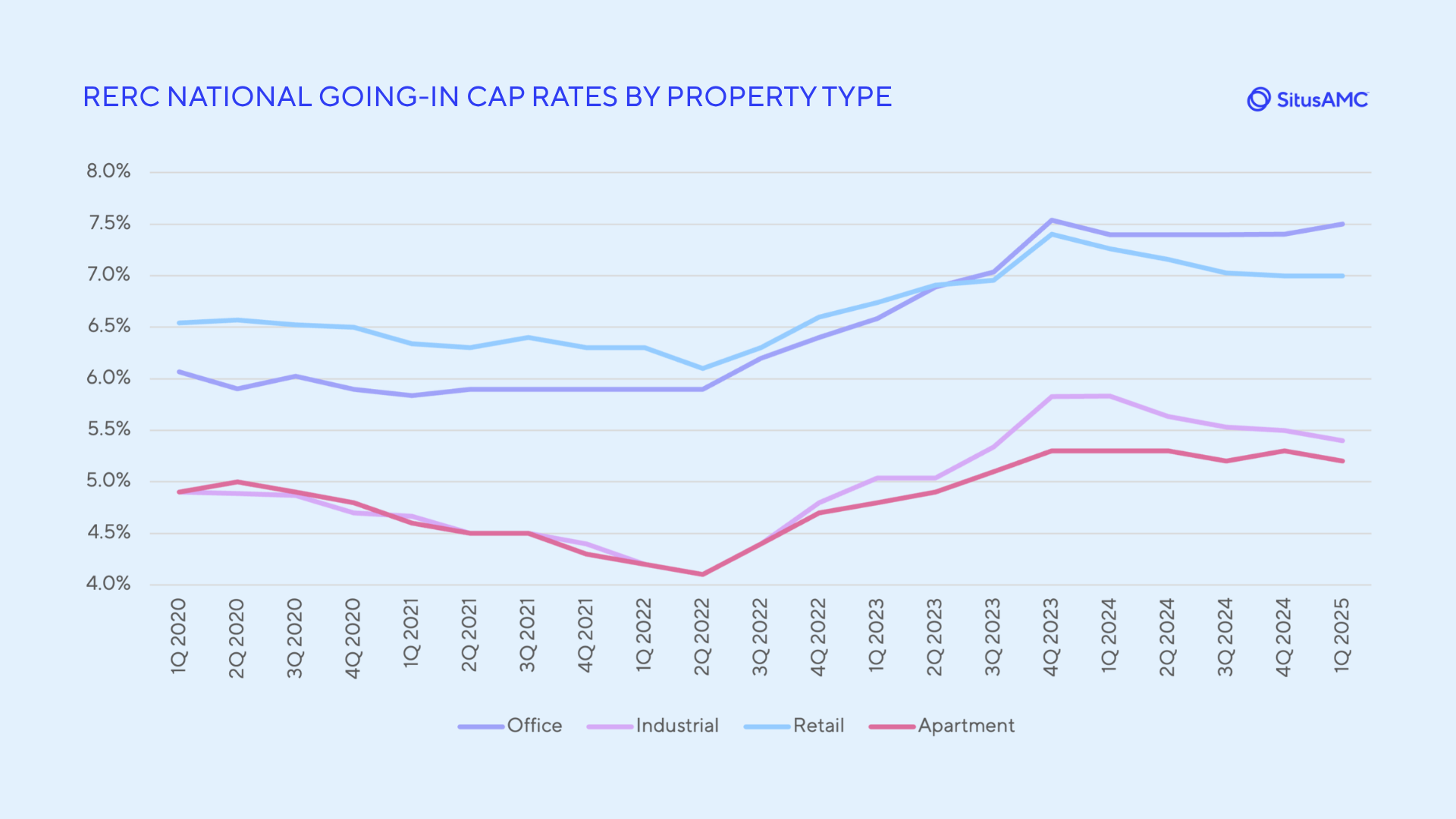

Retail operating fundamentals remain positive with steady rent growth, strong tenant demand, and limited availability due to constrained development, which is expected to continue for the foreseeable future. However, big box retail space could see a jump in vacancies as retailer bankruptcies start hitting the segment toward the end of this year. Investors are favoring necessity-based retail such as well-located grocery anchored centers. Despite the strong interest, there is a noticeable lack of core-plus grocery-anchored centers coming to market, leading to a scarcity of recent trades in this segment. With only lower-quality properties on the market, cap rates are hovering around 6% or higher. Lifestyle centers are gaining momentum with experiential appeal, while the bifurcation between top-tier and lower-tier malls persists. Additionally, banks have shown increased interest in the retail space. Should tariff concerns materialize, NOI growth could fall into the red but for now the sector remains steady.

Office performance is market-dependent but has mostly seen minimal changes in valuations and assumptions as the sector waits to see how the economy will play out. Select office markets show signs of bottoming out, with stronger leasing velocity particularly where return-to-office is strong, although concerns exist that economic uncertainty will halt decision-making for tenants. The sector still has a wide bifurcation between the highly leased Class A buildings and the struggling Class B/C, although in areas with higher occupancy such as New York City, the hope is that leasing velocity will trickle down into A-minus and eventually Class B. However, other areas like downtown Los Angeles and Washington D.C. are still struggling.

Sales activity is fairly strong for the sector with many recaps, partner buyouts, sales in conjunction with debt maturities and reallocation of portfolios to limit office exposure. Life science in particular is suffering value declines as the sub-sector deals with the significant amount of new supply that came online due to the strong fundamentals during COVID-19.

Self-storage is similar to previous quarters with stable valuations and slower rent growth in markets with more new supply; infill markets are experiencing better customer rate increases and rent growth. REIT and portfolio capital allocation could greatly influence market fundamentals as self-storage heads into its peak leasing season.

Debt Valuation Trends

- Loan spreads widened post-tariff announcement.

- Senior loans saw a slight tightening of spreads, but overall lending remains cautious.

- Transitional loan activity is increasing, driven by higher yields and renewed CLO manager interest.

Loan spreads widened in the aftermath of the April 2 tariff shock, around 15 basis points for senior loans across the board, and even by as much as 100 basis points for BBB. There has been some slight tightening in the short term for senior loans, but after the tariff announcement, there has not been much change to spreads in general. Transitional loan volume continues to grow due to higher yields, as well as CLO managers’ interest in entering the transitional loan space to securitize and close deals.

Special Servicing Trends

- Office remains the top stress point, especially in weaker markets; liquidations likely as extensions expire.

- Multifamily servicing tied to sponsor issues or unrealistic repositioning plans, not market fundamentals.

- Hotels could see rising distress due to elevated costs, labor shortages, and reduced travel demand.

Office remains a problem for the real estate industry, as many realize the “extend and pretend” strategy is unsustainable for the sector and liquidations are likely. Class A+ trophy properties still vastly outperform A- in most markets, although there is still a large difference in performance between improving San Francisco and New York City and struggling downtown Los Angeles and Chicago. Some multifamily loans are going into special servicing. But this is typically due to a bad sponsor or CRE CLO repositioning deals in which the plan was unrealistic or unrealized, not due to poor market fundamentals.

Retail has been solid aside from the poorly performing enclosed malls, in which the loans are typically repositioned when entering into special servicing. There may be a jump in hotel loans entering special servicing in the near future as headwinds emerge, including cutbacks in both leisure and business travel, the loss of immigrant hotel workers and high interest rates, which keep operating costs elevated.

Macro Trends

- Tariffs have had minimal capital budget impact so far but project delays are growing due to uncertainty.

- Deportation of undocumented construction workers threatens to slow projects and increase labor costs.

- Office-to-residential conversions are gaining traction, offering hope for reducing vacancies and easing housing shortages.

Tariffs have been a constant concern for the economy but the tariffs in place have yet to hit capital budgets. So far, capital budgets have seen an impact of 3% to 5%, which is relatively low considering budgets usually start with 5% to 10% contingencies to absorb changes to price. But it is early game as the tariff dust has yet to settle. Nevertheless, capital projects have still been delayed with many concerned about their budgets, even if changes so far have been minimal.

Another notable concern for CRE is the deportation of undocumented workers in the construction labor force. Construction is the industry with the largest share of undocumented workers. Deportations not only reduce the number of entry-level workers, but also those with high skill sets who cannot be quickly replaced, including craftsman, superintendents and engineers. If sites continue to get raided and workers are lost, building projects will likely be disrupted and operating expenses could rise.

The office segment is still struggling, but there are some green shoots. Return-to-office mandates have resulted in a slight increase in office usage. Although the hybrid work model, instead of the full-time office model, has become most prominent among businesses, office space will still need to be leased. Landlords continue to focus on reducing variable costs in order to support NOI. Additionally, we are seeing increasing momentum in office buildings being converted to residential properties such as Pfizer’s old headquarters on East 42nd Street or 5 Times Square in New York. With the need for affordable housing, politicians are easing regulations to make these conversions work. While office-to-multifamily makes up a small portion of total office space, it could help ease vacancies for the struggling sector, especially as conversion expertise builds, more capital is deployed and more localities provide support.

To explore more of SitusAMC’s resources and insights, visit our website at: https://www.situsamc.com/resources-insights/collection/commercial

To learn more about SitusAMC research, analytical tools, and data products visit our website.

The Latest from SitusAMC

ValTrends – July 22, 2025 at 2pm ET

Register for our next “ValTrends First Look” webinar, offering a forward-looking snapshot of the quarter ahead. Register here to attend.

Top 3 Bottom 3 Metros 1Q 2025

Proprietary analysis is based on the weighted average of NCREIF Classic NPI total returns across the main CRE sectors in 1Q 2025. Explore our analysis here.

The Numbers Game: How Proper CRE Loan Sizing Generates More Deals

We sat down with SitusAMC senior leaders to explore the benefits and risks of proper sizing, and the role artificial intelligence may play in the future. Check out the interview here.

Webinar: Valuation Trends & State of the CRE Market

Listen to our recent webinar featuring our Real Estate Valuation Services (REVS) team, where they analyzed current valuation dynamics and sector performance across the NCREIF NFI-ODCE index. Check out the highlights and the full webinar here.