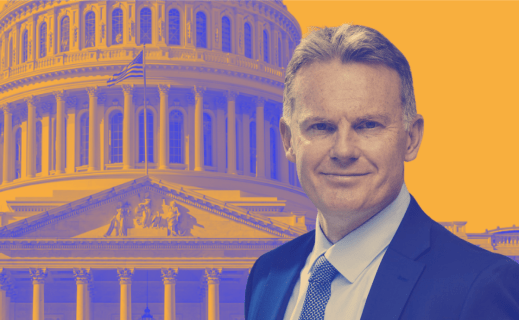

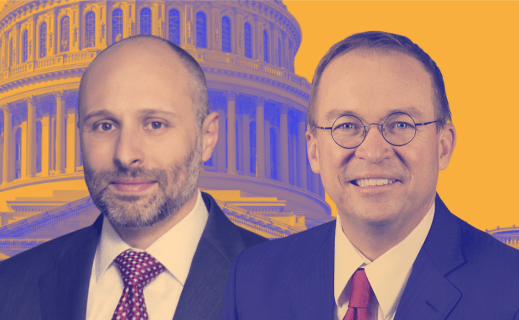

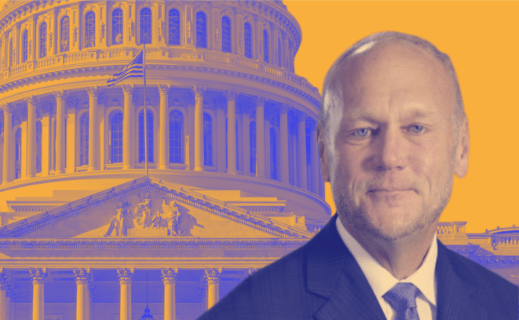

On the Hill Episode 10: Craig Phillips, Former Counselor to U.S. Secretary of the Treasury

In this episode of On the Hill, Tim Rood, Head of Industry Relations, talks with Craig Phillips, a Wall Street veteran and the top housing advisor to former Treasury Secretary Steven Mnuchin. For the first time, Phillips takes us behind the scenes in the Trump administration and talks frankly about why efforts to move Fannie Mae and Freddie Mac out of conservatorship failed.

When the administration was preparing its first budget in 2017, Mnuchin and Phillips proposed that the Treasury stop siphoning off the profits of the government-sponsored enterprises (GSEs). “Our very strong recommendation was to stop the sweep and take that money out of the budget right away -- day one, in January,” said Phillips. They received a “horrific reaction” from two camps -- one worried about the impact on the deficit, the other convinced the GSEs needed further reform before exiting conservatorship and raising fresh capital, he said.

The government took control of the GSEs in 2008 during the financial crisis to save them from collapse, and ultimately provided a $190 billion taxpayer bailout. In return the government received a special class of dividend-paying stock, and warrants to acquire most of the GSEs common stock. In 2012, the government decided the GSEs would pay virtually all of their profits to the Treasury, rather than requiring them to pay dividends in quarters when they weren’t profitable. (As a result, the GSEs have more than repaid funds borrowed from taxpayers.)

Efforts to end conservatorship were also overshadowed by other priorities, including tax reform and bank regulatory changes, and internal disorganization. “The biggest shortcoming when I look back at the Trump administration, there just wasn’t enough regular process,” Phillips said. “The president was prone to write tweets. He would react to things that weren’t part of our policy framework that … would be a distraction from the policy objectives. And it was just undisciplined and unconventional. And I think it was advertised that it was going to be untraditional and unconventional but many times that was without purpose. So there was constantly a tension with the press, not a good flow of information, and difficulty managing an agenda.”

Phillips joined the administration in 2017 as a Special Counselor focused on domestic finance, housing finance policy and regulatory reform, and left in 2019. He was previously a Managing Director and Member of the Operating Committee of BlackRock, where he served as head of financial markets advisory and client solutions, advising central banks, banking supervisors and multi-lateral organizations around the world, including the Federal Reserve Bank of New York. Prior to BlackRock, Phillips was the head of the Securitized Product Group at Morgan Stanley and co-head of U.S. asset-backed and mortgage-backed securities at Credit Suisse First Boston.